When Sales Prevention is Good

Apr 19, 2017cashflow risk sales

Cashflow is the lifeblood of small business. With a never-ending onslaught of salaries, rent, insurance, accounting fees etc, any cash coming through the door is a good thing. Or is it?

Quick Quiz: Deal or No Deal?

Time for a quiz. Have a read through the following scenarios and figure out whether you should do the deal or not. The answers are below.

We haven’t sold into this country before. They don’t speak much English and are eight timezones away. Trying to get the contract agreed was a painful process. We need to lodge a performance bond. It is pretty good margins and the main user is excited to be getting our product.

We don’t really do what the customer wants. We should be able to wing it. The team will have to burn a bit of midnight oil. But we’re at the limit of our bank overdraft and if we don’t see some cash in the next week or two the bank will probably call in the loan.

The customer wants a fixed price for the whole project. However, the tender documents specify that phase 2 and 3 scoping and design will only happen in phase 1.

I have to make a small “facilitation payment” to a foreign government official to get the sale over the line.

The customer wants uncapped liabilities on any loss they suffer as a result of using our products.

The customer requires me to add a whole load of features to the product. It’s highly unlikely any other customer will want those features.

The customer wants to own any IP developed as part of the deal.

Answers

Probably not, but it depends. There’s going to be a lot of pain involved in completing the sale, getting the all the documentation together, figuring out how to operate in a new jurisdiction etc. The project is likely to overrun as it is almost certain that what they think they bought is quite different to what you thought you sold. If there are really hefty margins in the deal, you are trying to open up this territory anyway and have a decent bank balance in case it takes a while to get paid then in may be worth doing the deal.

You probably have no choice. Leave signing to the last minute to see if you can make a sale closer to your core business. Price in paying the team a bonus if they pull it off.

No. Signing up for a fixed price contract with variable scope projects is just plain stupid. I was plain stupid once. Not quite as bad as the example above, but it hurt all the same. Talk to the customer’s procurement team as it is an uncommercial request. If they don’t budge, you could either submit a non-conforming bid or walk away. If your competitor wins a deal like this you can be sure they will be kept busy and out of your way for a long time.

No, No, No, No, No. Seriously. Most western countries have an equivalent of a “Foreign Corrupt Practices Act”. Even if you are operating through local agents or local subsidiaries, as a citizen of a western country you can be heavily fined and jailed for this kind of thing. If you think you got away with it and want to sell your business in the future it may not be possible due to the potential liabilities and reputational risk for an acquirer.

No. Not unless you can convince your insurer to pick up the tab if things go wrong. Good luck with that. If you don’t even understand what this is all about, find a good, pragmatic commercial lawyer and get them to explain the key concepts around warranties, indemnities, liabilities and commercial risk management.

Probably not. Every semi-custom feature costs money to develop, diverts resources from features that have a bigger market and creates a long term maintenance liability. If you really want the deal, at least price it in a way that passes on a good proportion of these hidden costs.

Probably not. If you are a product company, IP is the core asset you own. There’s no point being in business if you hand over everything you create. Pull out your negotiating manual and get back to basics. What does the customer actually need? What other deal frameworks can meet this need without breaking your business? Often a good IP lawyer can cook up a special licensing structure that meets their needs without compromising your ability to deal freely in the IP in the future, while also preventing your customer from setting themselves up as your competitor.

Deal Approval Framework

The board and senior management of an organisation should be focused on the long term goals and risk profile of the organisation in order to protect the interests of the shareholders they serve (I know that’s a somewhat old-fashioned and idealistic view).

Salespeople are typically focused on the current quarter’s sales results so they can collect their sales commission and buy themselves a nice new Maserati. If the company crashes and burns in 3 years’ time it is of little interest or consequence as they will probably have been fired well before then for missing a sales target. As a result, many salespeople will chase anything that has a dollar sign attached, even if it harms a company long-term.

To bridge these opposing objectives, most mid-size and larger companies have a deal approvals framework designed by the legal team (aka “sales prevention department”) and the sales operations management team. Both these groups typically have a longer tenure than the average salesperson so are more motivated to avoid blowback from bad deals. This deal approvals framework is used to assess sales opportunities, determine whether to pursue them, and if so, under what terms.

Not many small businesses have a deal approvals framework. However, it is useful to understand how they work in order to avoid issues down the track. As you grow it is useful to formalise one.

A Sample Framework

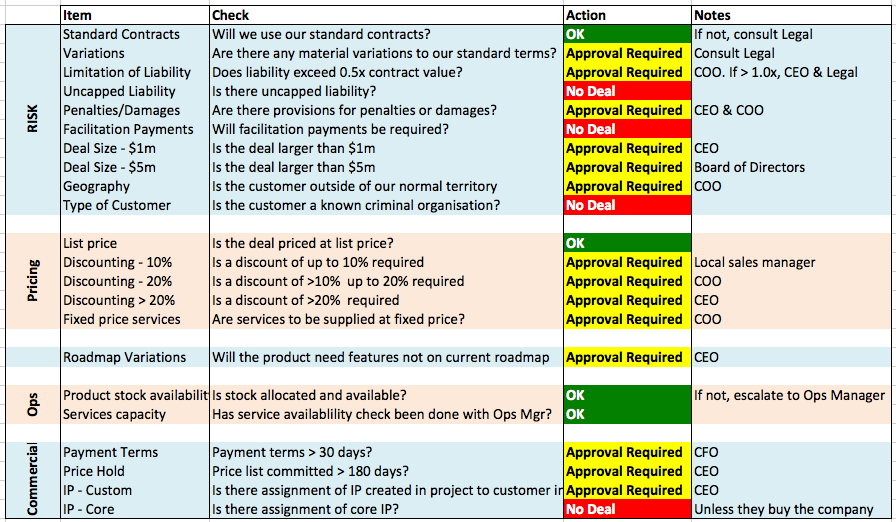

Here’s a very simple example of a deal approvals framework. It is not complete.*

It’s pretty self-explanatory. As a salesperson, for each opportunity you go through the checklist. If the checklist says you need approval you seek approval. The approver should, in theory, have a broader view of the business objectives and therefore be able to make an informed decision on whether to chase a higher risk deal. If a deal isn’t approved you either reshape the deal (e.g. negotiating liability caps and IP clauses) or go focus on the next deal.

If you sign a non-conforming deal that hasn’t got the right approvals you either lose your commission or lose your commission and your job. Harsh, I know. But so is losing your job because some stupid sales guy sold a deal that sunk the company.

* Normal disclaimers apply - don’t sue me if you rely on this and sign a bad deal.