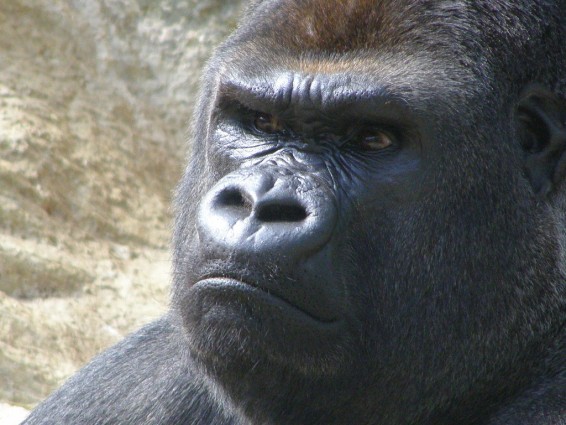

Oops - The Gorilla Just Sat On Me

Nov 15, 2015projects customers cashflow risk

Now back to reality.

Yes - this deal will indeed change the face of the company. It will either grow and succeed or crash and burn. There’s no half measures with a gorilla deal.

A good part of my working life has been spent building, selling and implementing business software so today we’re going to have a look at how big companies accidentally stifle or kill small software vendors. I’m sure this applies to all small technology vendors, and I’m sure most of this applies to all small vendors of any kind.

A deal isn’t a deal until you have the purchase order.

You go through the trials and tribulations of presenting, running demos, doing technical evaluations, having some forensic accountant delve into your books to confirm you are a viable entity and you come out victorious. You have a signed contract to supply the gorilla. As soon as you have recovered from the champagne hangover you go on a hiring spree to service the workload. Then you wait. Nothing’s happening… Not quite nothing - your cash is draining out of the bank account paying for all the new hires.

So what’s going on?

Possibly one of many things, but fundamentally you are dealing with different parts of a large organisation to pull off a big deal and a lot needs to be synchronised for things to happen quickly. For example, the procurement team will be working on multiple contracts and the line of business buyer will have forgotten what they were doing by the time the procurement team has finalised negotiations, fixed up terms and conditions and all kind of other legal minutiae and executed contracts with you. The line of business buyer then has to get back on track and start organising themselves around a project, but some operational issue has blown up in the meantime. So they get back on track and start the project a second time around, at which point they remember they need to issue purchase orders against the original contract to get something to happen. Meanwhile you’ve gone bust. The gorilla just accidentally sat on you.

What can you do about it?

Well, first of all, don’t get excited and start expanding before you see the initial contract turn into a commitment to pay. To support this you need to tie cost to revenue in the contracts. If you have to hire, hold resources or buy raw materials to service the contract then you need to be paid for it. If the gorilla customer won’t pay in advance then you don’t hold resources or lock in your costs. Non-negotiable. This is the kind of thing you will lose your house and family over.

Accounting revenue does not equal cash

Side lesson #1: You can book earned income (e.g. hours spent on a project, widgets shipped) and you can calculate profits but until the customer transfers the money you do not have the ability to spend that money on important things like rent and salaries.

Side lesson #2: Gorillas have two important attributes. They are dominating and they are slow. They dominate your management time and your resources and should dominate your revenue. However, they are slow moving, particularly with their accounts payable. That means a significant portion of your revenue may not convert to cash for some time. This is fine if you have a bloated bank account, but more than likely you will not have the money to spend on important things like rent and salaries.

Now gorillas generally aren’t slow because they want to be. They have internal processes to ensure people aren’t stealing money or spending it on stupid things like office dishwashers and bribing government officials. These processes can move slowly, particularly if key approvers are on vacation. They also have things called payment runs which may only happen every couple of weeks. If you miss one you have to wait for the next one to get your cash. Yes, I know we are well into the 21st Century but it does still happen like this.

Gorillas also sometimes convince themselves they should implement ERP systems. These projects are big and complex and kill off accounts payable functions for months at a time.

What can you do about it?

If you are in the middle of this it is tough. The emotional and reputational pressure to keep working is intense. However, as a founder/director/senior manager of your company you have a duty to keep your company solvent. This gives you the “higher authority” you need to have the tough conversations with your customer.

If you need to camp outside their CEO’s office to get your invoices paid then that’s what you must do. If you need to divert all of your resources to fast sources of cash then that’s what you must do. And you should explain to the representatives of the customer you interact with what you are doing and why, and that you really don’t want to but under corporation law you have no choice.

An ounce of prevention is better than a ton of cure. Multiple calls to accounts payable and the customer’s nominated representative the second a payment is late sets the tone for the relationship - that you are professional and on top of the admin side of the business. And that you won’t tolerate being given the run around. Divert the project team for a day to another account, or onto internal projects to show you mean business. Again, you can lose your house and family over a gorilla’s glacial payment system so take it seriously and show you take it seriously.

“I insist on fixed cost even if it kills me too”

Big companies seem to think that fixed cost projects are lower risk to them. And they may be when dealing with mature vendors with mature technology who have done a hundred similar projects and have enough cash in the bank to get through the odd project overrun without losing their shirt. If you are a small vendor, however, you absolutely need to negotiate out of this for your sake and theirs. A large, fixed cost project can kill your business. Here’s how:

Big customers typically have big project management systems. These introduce way, way more overhead than you ever imagined possible as a small, agile vendor. In the contracts you skim over the clause which says you will abide by the customer’s project management systems. That one simple clause contains a world of pain. Change control documentation, acceptance testing, test evidence and on it goes. You can probably throw in the odd half day safety induction for each of your team members if you are working in that kind of industry.

You didn’t price in this overhead so you didn’t see the 40% extra cost coming your way.

Small vendors normally have a technical guy leading a project who thinks every new feature is a cool idea. When the customer says “Can we add a new screen which shows how late we are with the project?”, your technical guy says “Hey, that would be cool. Yes it should be in there - I’ll have it done next week”. Instead of: “That’s outside the project scope. If you send through a change request we’ll let you know impact on the price and schedule by mid next week and you can decide if you want to proceed”. The project never ends. Your costs never end. But your revenue grinds to a halt.

One of two things then happens.

You lose interest in the project which is haemorrhaging cash and it never gets finished - not good for the gorilla customer.

You go out of business and the project never gets finished - also not good for the gorilla customer.

Armed with this it should be possible, though not easy, to negotiate your way out of a fixed price engagement. Once you have done a few similar projects and know what’s involved and have reasonable working capital available by all means go fixed price - the margins can be way better when done properly. Just not for the first few.

Gorilla deals can kill your business in many other ways. Big companies like to take over have input into your development roadmaps so your products end up being designed for a single customer, not for a market. There goes your growth potential.

Big companies like to insist on locking your key staff into their projects. Congratulations - you just became the gorilla’s bitch a bodies-for-hire company, not a product company. There goes your growth potential again.

Big companies retrospectively insist on certified quality management systems. There goes another chunk of your shrinking margin. And on it goes.

A huge deal with a big customer can be a company maker, it’s true. But if you go in unprepared these huge deals will be a company breaker. If you don’t have anyone on your team who has the grey hair and scars from this kind of deal in the past, tread carefully. You will almost always be better off building capability, cash and experience with a few smaller, friendlier customers.

Photo credit: frank-wouters